Learn How To Trade Forex

How to Get Started in Forex Trading

If yous want to get into Forex trading, hither are five steps yous should take to get started..

-

Make up one's mind what kind of trader y'all desire to exist.

This will depend firstly upon how much fourth dimension you are able and willing to dedicate to trading. If you tin check in once a mean solar day, yous volition need to exist a position trader. If you lot can spare a few minutes a few times a day, you will exist a swing trader. If you wish to dedicate annihilation betwixt one-half an hour and a few continuous hours daily (or on some days), yous will be scalping. There is no reason why y'all cannot prefer more than than one style if you have enough time to manage information technology all. Beginner traders are brash to offset with swing or position trading as these styes are less challenging for most than scalping. The blazon of trader y'all want to be volition affect which Forex brokers are best for you.

-

Decide how much money y'all can afford to risk trading Forex.

It is essential that yous only trade Forex with money you can beget to lose. This is because most beginner Forex traders suffer heavy losses inside a few months. You do non have to be one of them, simply trading is an uphill struggle for most beginners, so be realistic and conservative about risk. On the other hand, be aware that the more funds you lot can deposit with a Forex broker, the better deal you will typically get regarding fees and costs.

-

Choose your trading strategy or strategies.

Every Forex trader needs at least one bones strategy to propose merchandise entries and exits, fifty-fifty if an element of personal discretion is used. Whatsoever strategy should have a long track record of a positive "edge": whatever strategy that has not been extensively dorsum tested is worthless. It is tempting to think you can buy access to a "holy grail" strategy, merely there are plenty of free Forex trading strategies for beginners you tin can notice online to use which are only every bit proficient as whatever paid textile.

Information technology is important to dorsum test any trading strategy use because y'all need to have conviction that a strategy will piece of work over the long-term to use it effectively.

Read as much as you can about Forex trading. Do not worry about learning well-nigh all the many indicators and features. Focus instead on reading honest explanations and debates from real traders who admit to losing streaks, considering this will be 18-carat advice and non marketing.

-

Make a shortlist of suitable Forex brokers and open demo accounts.

Every Forex broker has a minimum deposit requirement, and some brokers are better for certain styles of trading. Later on answering the showtime ii questions above, you volition go a better idea of which Forex brokers will be all-time for y'all. Inquiry brokers using reputable broker reviews of the best Forex brokers for beginners and make your shortlist, and open demo accounts at each. These risk-gratuitous test accounts require no deposit, just registration with the broker, and can be opened very quickly and easily. Forex demo accounts are ordinarily valid for 30 days, although some brokers allow their demo accounts to run for much longer, or even for unlimited time in a few cases. Trade your strategy on the demo accounts.

-

Choose at least one Forex broker from the shortlist after experiencing the demo business relationship trading.

Yous are now set to showtime trading with real money once you make the deposit into your alive account(south). Y'all will find this has a different experience to demo account trading. Make sure you practice not take a chance as well much per trade and endeavor non to go angry about losing trades, which are inevitable. Keep assessing what you lot do from time to practise and proceed runway of your results. You will probably not attain quick success only will improve with exercise. Until you get a confident and profitable trader, the almost of import thing is non to lose likewise much money.

Forex Trading Example

Here is a trading example using the EUR/USD, the nigh traded and nearly liquid currency pair, which has the tightest spreads at every online Forex broker. Permit united states of america take an exchange charge per unit of i.2225, the purchase (ask) cost with 1.0 lot in volume and leverage of 1:500, a take turn a profit of 1.2300, and a finish-loss of 1.2200.

-

Buy 100,000 currency units (1.0 lot) at 1.2225 = $122,250

-

The margin requirement is $122,250 / 500 (one:500 leverage) = $244.50

-

The take profit at 1.2300 equals a 75-pip motion (1.2300 - 1.2225) ten 100,000 (one.0 lot) for a profit of $750

-

The stop loss at i.2200 equals a 25-pip motility (1.2225 - i.2200) ten 100,000 (1.0 lot) for a loss of $250

The risk/reward ratio is i:3 ($750 / $250)

What is Forex Trading?

Forex trading, as well known as foreign exchange or FX, refers to ownership and selling currencies against each other. Over ane hundred currency pairs be, and the most liquid one is the EUR/USD. Due to global trade and finance, the Forex market, where currency pairs trade, is the almost liquid one. Forex trading takes place 24/5 and has the lowest majuscule entry requirements, together with the highest leverage. It is likewise ideal for automated trading solutions, and the nugget selection remains pocket-size compared to equity trading. Most brokers provide between l and 75 currency pairs, and the interconnectivity and liquidity allow Forex traders to deploy focused trading strategies. Scalpers often focus on a handful of currency pairs. Forex trading provides many opportunities and is accessible to all traders with few geographical restrictions. With the need from new Forex traders rising, it unlocks new business potential for many. Our Forex trading for dummies crash course volition outline strengthen your knowledge almost Forex trading from where you lot can nautical chart a profitable form forward. Just remember that yous must learn before y'all tin earn. Many new traders skip this part, and the outcome is e'er the same.

How do Currency Markets Piece of work?

Unlike equity and commodity markets, the Forex market is decentralized and trades 24/5. It consists of a global network of banks, hedge funds, private equity funds, exchange-traded funds, mutual funds, businesses, and individuals. All market participants continuously buy and sell currencies in the over the counter (OTC) market. It creates constant toll fluctuations and trading opportunities. There are no central locations, but four master global trading hubs be. They are Sydney, Tokyo, London, and New York. The opening and close of the London and New York trading sessions, as well as the London / New York session overlap, present five of the most meaning and liquid trading times , and also when virtually retail traders are unable to trade due to their employment elsewhere. Forex trading is a profession, and a highly enervating one, and unless traders treat information technology as such, losses beyond portfolios are all but guaranteed. Other notable trading hubs include Zurich, Hong Kong, Singapore, Frankfurt, and Paris, with numerous emerging ones located in BRICS and Asean countries. Traders tin can buy and sell, also known as going long and short, respectively, and profit in either direction. Due to the fast-moving nature of currency markets, automatic trading solutions provide a competitive border and account for over 2-thirds of all trading book outside Japan. Since London remains the most liquid global financial eye, numerous Forex trading for beginners Uk editions emphasize its unique Forex trading infrastructure.

What Moves Forex Markets

Understanding what moves Forex markets is essential to the success of Forex traders. Remember that currency pairs always consist of two currencies. Therefore, traders must consider developments in both, as either one tin can move price activity. The three chief Forex market movers are economic information, central bank policy, and geopolitics. Forex traders often provide the quickest reaction to any issue. Since economic reports follow a fix schedule, in-depth calendars requite Forex traders sufficient visibility. Some traders attempt to profit from the frequently-volatile menses before and after a release, known as news trading. Central bank meetings are every bit transparent from a scheduling perspective and can innovate long-term tendency changes or force breakouts and breakdowns. Geopolitical events will surprise Forex markets equally they are 100% random events. It adds excitement and trading opportunities. It also adds doubtfulness and losses for those who leave their portfolios unprotected and fail to deploy gamble management. Most Forex for dummies courses neglect to cover risk management adequately as part of a successful trading strategy.

History of Forex

Forex trading has existed since countries began minting currencies , but today's Forex markets remains relatively new. Some equity markets exist for hundreds of years, but it was not until the 1971 Bretton Woods accordance that Forex markets became operational. Post-obit the 1971 understanding, major currencies became gratuitous-floating, driven past supply and demand, economic factors, central banking company actions, and geopolitical developments. It created the demand for Forex markets, where operators pair currencies against each other. Over the by decades, more Forex pairs became bachelor for trading. Demand continues to ascension, and trading related services aggrandize to satisfy information technology. Thousands of brokers, asset management firms, analysts, point providers, adventure managers, and lawyers cater to Forex traders. It also provides a significant heave to the economies of trading hubs. With automated trading strategies representing the fastest-growing segment of finance, the Forex market place became one of the showtime to embrace and support the tendency. Information technology was non until the release of the MT4 trading platform by Republic of cyprus-based MetaQuotes in 2005 that online Forex trading added hundreds of millions of retail traders. MT4 was the first full-featured version, and the vision of MetaQuotes allowed information technology to take a ascendant position, which it continues to savor today.

Forex for Hedging

Many international companies utilize the Forex market to hedge their currency exposure and even to lock in future exchange rates to gain clarity over operating expenses. I example is a manufacturing visitor producing appurtenances in the US and selling them in Nippon. The production cost and the selling toll remain fixed in U.S. Dollars and Japanese Yen, respectively. Since the USD/JPY currency pair fluctuates, the product profitability volition vary on the substitution rate, excluding inflation. The manufacturing company may lock a specific substitution charge per unit in forwards or bandy markets. It offers a hedge against currency movements and provides more stability and visibility over expenses. Information technology likewise reduces turn a profit potential if the exchange rate moves in the direction favoring the manufacturing company. Airlines are another prominent case, as they hedge against price movements that impact jet fuel, which similar near bolt, remains priced in U.Southward. Dollars. By ensuring a fixed exchange rate, the company maintains short-term cost control over operating expenses. Some companies employ a skilled trading desk-bound and utilise Forex for hedging to add to the operating profits, especially commodity firms and companies with dominant exposure to the sector. Equity traders too use Forex for hedging, every bit currency pairs offer a low-price and highly liquid tool to hedge trading portfolios.

Forex for Speculation

Due southpeculation is i of the primary reasons many traders flock to the Forex market and learn how to trade Forex. Since currency pairs continuously move 24/5, impacted by numerous factors throughout each trading session, traders have many trading opportunities. It increases the turn a profit potential, calculation to the attractiveness of Forex trading. In that location are many ways to speculate on how one currency pair volition motion confronting another one. Some traders prefer to do so on fundamental developments similar economic data, central bank announcements, and geopolitical events. Others have their trading clues from technical analysis, using indicators and past cost activeness to predict future currency fluctuations. Both sides have proponents and opponents, oftentimes resulting in massive disagreements over which arroyo grants traders an edge. Profitable traders sympathize the importance of both, allowing them to speculate on cost activity in the Forex market with greater accuracy. Traders must understand which market place events lead to brusk-term fluctuations inside an established trend and which ones possess the power to change existing trends. Forex for speculation can yield remarkable profits, particularly in conjunction with leverage and risk management, but it takes years to primary information technology. Traders employ scalping to speculate on ultra-short-term Forex moves, generally based on one-infinitesimal (M1), ii minutes (M2), and v minutes (M5) charts, with technical indicators as the ground for entry and exit positions. Automated trading fulfills a defining role for traders who speculate in the Forex market for a living or derive a substantial portion of their income from it.

Currency as an Asset Class

Besides hedging and speculation, currencies offering investors ii highly-seasoned income avenues, making them an asset worth accumulating in long-term portfolios. Given the liquidity of the Forex market place, portfolio managers remain flexible. They can rotate out of positions with ease if conditions change. The most obvious manner to profit from currencies is via commutation rate fluctuations. Identifying long-term cardinal trends and using technical analysis for entry opportunities is i of the most used trading strategies. They ignore short-term economical reports and focus on multi-month scenarios supported by deadening-moving technical indicators. Another way to earn money from a currency pair equally an asset grade is via interest rate differentials. Earlier global key banks ruined the fiscal system by slashing them to nil or almost zero, and in some cases below zero, one of the most deployed strategies was a carry trade. Deport trade refers to short a currency pair with low-interest rates and buy 1 with loftier-involvement rates. The Japanese Yen was the primary curt-selling target, with the British Pound the top long positions, making the GBP/JPY a highly traded currency pair. Since the 2008 global fiscal crisis, comport trades became riskier as all major currencies have low-interest rates, while high-gamble emerging markets maintain higher ones.

Forex Trading Risks

While Forex trading provides many opportunities, it also carries pregnant risks, equally the retail market is almost entirely closed over weekends. The interbank market, where banks trade with each other and decide substitution rates, faces diverse regulatory oversight, depending on their location. Banks accept to accept numerous risks, including sovereign, credit, and counterparty risk. Each banking concern deploys a gamble management department to shield itself equally much every bit possible. Forex products are not standardized, and different regulators approach Forex trading with varying degrees of rules, while a few exercise not regulate it at all. Therefore, trading from a competitive jurisdiction can offer traders an border, with the EU the least competitive ane. Supply and demand dictate currency pair prices, simply retail traders of market-making brokers may face re-quotes, and stop-loss hunting, exposing them to risk imposed past untrustworthy brokers.

Managing the risks of Forex trading

Managing the risks of Forex trading will define the outcome of whatever trading strategy. Forex trading for dummies generally covers other aspects, and misleading label leverage is why retail traders lose money. The lack of chance management leads to losses, and most traders apply a static number for their stop-loss orders in a dynamic market. While it offers protection and ensures trading losses do not exceed a ready amount, it is far from an in-depth and effective take a chance management strategy. I urge all traders to acquire about managing the risks earlier thinking about trading strategies and order placement.

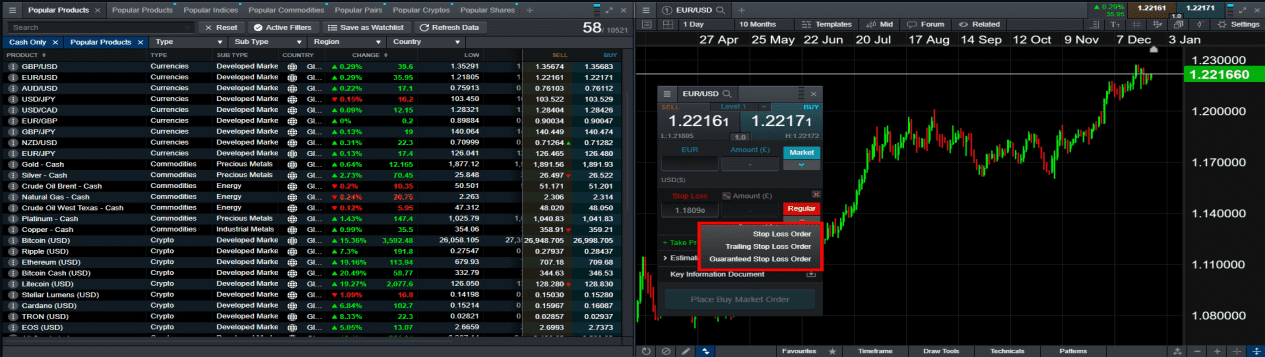

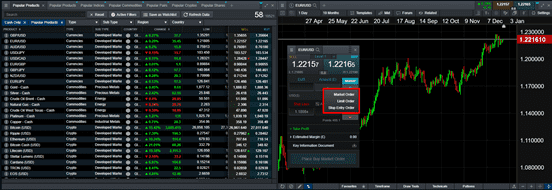

Two order types to aid with managing the risks of Forex Trading:

- Stop-loss order - It closes a trading position at a set level. A finish-loss lodge does not guarantee the cost. Execution is dependent on market conditions and the liquidity of brokers, merely well-nigh will trigger at or near the ready level. Some brokers provide a guaranteed stop-loss lodge for a fee. It ensures that the entered price is honored. A trailing terminate loss will adjust with price action. Professional traders and profitable retail traders use a stop-loss order to close trades at a profit.

- Limit lodge - Information technology executes an order at a futurity price or superior level. A buy limit lodge and a sell limit gild volition only trigger at the set price or below and above, respectively. Information technology offers traders more control over social club placement. While the price is guaranteed, the order filling is not, and again depends on market weather condition and broker liquidity. Limit orders together with cease-loss orders tin protect the downside of portfolios, but traders may too miss trading opportunities in fast-moving markets.

Pros and Challenges of Trading Forex

Before new traders decide if Forex trading is right for them, I recommend that traders consider the pros and the challenges of trading Forex. Information technology can provide the necessary insight to make an informed decision. I believe the below list offers an objective summary of items each trader must understand before moving ahead.

The pros of trading Forex:

- The Forex market is the near liquid financial marketplace, creating endless trading opportunities every day. Information technology presents all trading strategies with excellent trading weather, and traders can earn money in either direction.

- Low capital requirements and loftier leverage get in attainable to traders of all portfolio sizes. Virtually online brokers have low to no minimum deposit requirements, allowing clients to deploy a portfolio-edifice strategy suitable to their needs.

- The limited asset pick of only above 100 currency pairs offers traders more than oversight and a focused approach to trading. Since many currency pairs are interconnected, about traders prefer to trade only a scattering of currency pairs to avoid overexposure.

- Forex trading is decentralized and takes place 24/5 and unofficially begins with the trading in Australia and ends with trading in New York. London remains the dominant trading hub, and other master ones include Tokyo, Zurich, Hong Kong, Singapore, Frankfurt, and Paris. Emerging hubs consist of member countries of BRICS and Asean.

- Limitless educational content can be accessed free of accuse, providing valuable lessons. It includes currency trading for dummies courses, more detailed how to trade Forex lessons, and specific editions like Forex trading for beginners Britain.

- A rich support infrastructure is available, including tens of thousands of analysts, bespeak providers, and business relationship managers.

- Forex trading is platonic for automated trading solutions, decreasing the gap betwixt retail traders and professional person ones. While they are costly, anybody interested in trading Forex for a living must consider information technology as an investment.

The challenges of trading Forex:

- Leverage remains one of the virtually misunderstood and misused trading tools. The majority of marketplace participants equate it to trading losses in the retail sector. I cannot stress enough that the lack of gamble management results in losses and not leveraged trading products.

- The corporeality of misleading data represents one of the most significant challenges, specially for new retail traders. False promises of profits from micro portfolios, no noesis needed, and express time spent trading remain challenges. They create scores of new traders that find nothing more than losses and disappointment.

- Forex trading is 1 of the to the lowest degree respected professions, equally near do not consider information technology as such. They arroyo it with the wrong mindset and neglect to understand that successful Forex trading is one of the most demanding professions.

- New traders skip the learning part of Forex trading, ignore adventure direction, and prefer to deploy express resources to trading. Information technology requires an understanding of cardinal aspects like economic reports, key bank policy, and geopolitical events. Technical indicators of Forex trading are as important, and how both interact and complement each other is the virtually defining aspect of a profitable Forex trader.

- Scams and fraud pry on new retail traders ignoring the facts. They follow social media marketing campaigns and fall victim to avoidable malpractice, including from scores of brokers.

Base Currencies and Quote Currencies

Forex trading is done via currency pairs, consisting of two currencies, for example, the EUR/USD. The former is the base currency, and the latter the quote currency. A EUR/USD toll of 1.2220 ways that for €1, traders will receive $1.2220. Traders e'er buy or sell one currency against another one, which forms the basis of Forex trading. A buy order, or going long, in the EUR/USD will result in profits if the toll increases and lose money when it decreases. A sell order, or going short, in the EUR/USD, yields the reverse, earning traders a turn a profit if the price decreases and losses if it increases.

Forex Pair Categories

Currency pairs in the Forex market belong to three singled-out categories, majors, minors , and exotics . Most major currency pairs remain associated with the United states of america Dollar, the reserve currency of the world. The three exceptions are the EUR/GBP, the EUR/CHF, and the EUR/JPY. Therefore, the ten major currency pairs consist of the EUR/USD, the world's nearly liquid currency pair, the GBP/USD, the USD/CHF, the USD/JPY, the three commodity currencies USD/CAD, AUD/USD, and NZD/USD, and the 3 non-The states currency pairs EUR/GBP, EUR/CHF, and EUR/JPY. Near traders prefer the ten, as they remain the most liquid and carry the lowest spreads. They are ideal for brusque-term trading strategies like scalping and account for over 85% of all daily trading volume.

Minor currency pairs consist of whatsoever not-US Dollar pairing between the major currency pairs. Some examples include the GBP/CHF, the AUD/JPY, and the AUD/NZD. They are less liquid, accept lower trading volumes, and the mark-upwards is notably higher. They present attractive opportunities, but traders must deploy different strategies. Exotic currency pairs represent all other assets in the Forex marketplace. The USD/BRL, the USD/INR, the USD/TRY, the USD/SEK, the EUR/PLN, the EUR/ZAR, and the EUR/CZK are vii examples. Trading emerging markets presents an excellent cantankerous-currency diversification trade and admission to higher interest charge per unit environments for carry trades but comes with unique sets of risks and challenges.

What is the Spread in Forex Trading?

The spread in Forex trading refers to the difference in the sell (bid) and purchase (ask) price of a currency quote. The inquire price is always higher than the bid price, and past default, traders face up a loss when opening a trade. Brokers utilise mark-ups on currency pairs, which represent their profit. The raw spread of the EUR/USD, derived from supply and demand on the interbank market, is commonly between 0 pips and 0.1 pips. Brokers who deploy an electronic communication network (ECN) execution model provide clients access to information technology for a commission toll per volume. I recommend ECN trading for most traders, every bit it enables all trading strategies, and most brokers provide a volume-based cash rebate programme, which lowers the last trading costs.

Market makers offering commission-free trading with higher spreads. A competitive i is 0.iv pips for the EUR/USD, which has the everyman mark-upward due to its liquidity and trading frequency. Anything up to 0.7 pips is acceptable, while I recommend traders avoid anything above that. The spread in Forex trading remains the almost significant direct trading costs. In a US Dollar base business relationship, 1.0 pips in the EUR/USD equals $10. Therefore, if the EUR/USD price moves from 1.2220 to 1.2221, a trader who bought this currency pair has a floating turn a profit of $10, and 1 who sold has a floating loss of $x. Buying 1 lot of EUR/USD at ane.2220 with a spread of 0.vii pips will show an firsthand loss of $7 without cost movement.

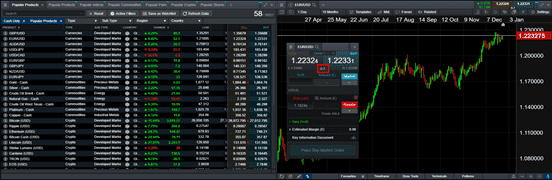

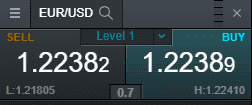

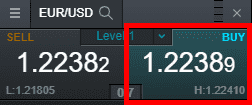

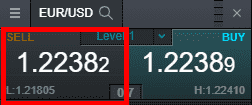

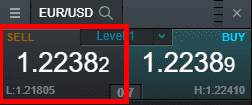

The below example shows the EUR/USD with 0.7 pips spread, displayed betwixt the sell and buy buttons.

How to Read a Forex Quote?

Reading a Forex quote is uncomplicated and straight forward. Each consists of two values, sell (bid), and purchase (inquire), while the difference is the spread. In the beneath EUR/USD example, the Euro is the base currency, and the US Dollar is the quote currency. Traders who wish to buy €1 with United states of america Dollars require $1.22389, the enquire price, to do and so. Those who want to sell €1 volition receive $1.22382, the bid price. When only one value exists, it always refers to the purchase (ask).

Long & Short

Buying and selling in the Forex market is an exchange of the base currency for the quote currency, hence the name foreign exchange market, usually abbreviated to Forex or FX. Traders can profit from toll activity in either direction. Those who want to buy a currency pair will do so at the buy (ask) price and those who sell at the sell (bid) price.

Long, going long, or taking a long position refers to ownership a currency pair. Traders who buy will do and so with the quoted buy (inquire) toll.

Short, going short, or taking a short position refers to selling a currency pair. Traders who sell will practise and so with the quoted sell (bid) price.

Apartment or Square

Traders with no positions in the Forex market place are apartment, which means cypher exposure to price action. Closing an open up trade is known every bit squaring, leaving portfolios flat. Each manufacture has a unique terminology that oft confuses new entrants. A Forex glossary usually covers them, proving the best resource. Traders may as well consult ane of the many Forex for dummies guides for assist.

Common Forex Terms

Understanding the well-nigh common Forex terms volition subtract the learning curve. It will allow new traders to understand educational material better and accelerate the learning process.

Pips, Lots, and Margins

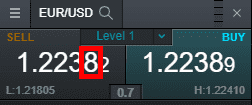

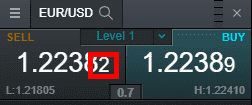

A pip is the 4th decimal in a non-JPY related currency quote, or the 2d decimal in a JPY-related quote. In our EUR/USD case, looking at the sell price of one.22382, the number eight is a pip. An increase to 1.22382 results in a 1.0 pip accelerate.

A growing number of brokers provide five decimal quotes, known every bit a pipette. Each pip consists of ten pipettes. A price move from ane.22382 to 1.22383 is equal to one pipette. Since the raw spread for the EUR/USD is 0.0 pips, meaning the sell (bid) and buy (ask) prices are identical, the smallest quoted increment is 0.1 pips or ane pipette.

Currency volumes remain expressed in lots. 1 lot is equal to 100,000 currency units, and if a trader sells ane.0 lots in the EUR/USD, information technology refers to exchanging 100,000 Euros for US Dollars. In other words, a trader exchanged €100,000 and received $122,382, using our EUR/USD example. In a US Dollar base of operations business relationship, one.0 pip for 1.0 lot in the EUR/USD equals $10. A mini lot is 10,000 currency units or 0.10 lots, while a micro-lot is 1,000 currency units or 0.01 lots, which is the minimum transaction size at most brokers.

Since Forex trading is available in margin accounts, traders do non have to pay the full amount of the transaction value, only only the required margin. The margin requirement depends on the currency pair and the jurisdiction of the banker. The EU forced brokers into an uncompetitive position, limiting leverage to ane:xxx, equal to a margin requirement of 3.33%. The United kingdom of great britain and northern ireland may revert to the standard of 1:500 following the finish of the Brexit transition catamenia. It is available in Australia and all other trading-friendly regulatory environments and equals a margin requirement of 0.50%. In our above example, rather than needing $122,382 for the transaction, a trader must have the required margin of $611.91 or 0.50%. A 0.01 lot trade requires $vi.1191, enabling traders with relatively small deposits to trade Forex.

What is a Bid?

The bid is the sell toll of a currency pair. It is well-nigh always lower than the ask price except at an ECN banker during times of heavy market turbulence. Traders who go long a currency pair volition get out their position at the bid cost, while traders who go brusque will enter at the bid price and get out at the enquire price.

What is Ask?

The ask is the buy price of a currency pair, and almost always higher than the bid cost. Brusque sellers in a currency pair will close their position at the ask price, and those with long positions will practise so at the bid toll.

What is Spread?

Spread is the deviation betwixt the bid and inquire toll. At market place makers, they include the broker marker-up. At ECN brokers, traders accept admission to raw spreads available in the interbank market, sourced from multiple liquidity providers.

Run a risk/Advantage Ratio

A adventure/reward ratio displays an adequate risk for a gear up reward. For instance, if a trader places a take-turn a profit at 50 pips from a Forex trade (the reward) and places a stop-loss club at 20 pips (the risk), the risk/reward ratio is one:2.5. It divides the profit potential past the downside potential. Virtually traders seek a minimum between 1:2 and 1:iii.

Unlike Ways to Trade Forex

There is more than one way to invest, speculate, or merchandise Forex. I have outlined the following iv every bit they account for most of the daily turnover.

- Futures - Currency futures are contracts that lock in a specific exchange rate at a time to come date and an obligation to deliver. They are well-regulated and less liquid but allow companies to control expenses. They were created by the Chicago Mercantile Commutation (CME) in 1972.

- Options - Options contracts give the holder the right but not the obligation to acquire the underlying currency pair at a specific date on the decease date. Traders often apply options to hedge their positions.

- ETFs - Substitution-traded funds entered the scene in December 2005, when Rydex, now Invesco, launched the Euro Currency Trust. ETFs provide traders with a passive nugget to participate in the Forex marketplace. It tin consist of a single currency or basket of currencies.

- Spot FX - This is the core of the decentralized Forex market, while the higher up three merchandise on centralized markets with regulatory oversight. Spot FX is an over the counter (OTC) product, traded 24/5, and refers to the commutation on the spot of a currency pair at market prices.

Forex Market Analysis

One of the most essential, repetitive, and enervating tasks of Forex trading is Forex market analysis. Successful traders either use technical analysis, fundamental analysis , or a combination of both to place trading opportunities, entry levels, stop-loss, and take-profit values and go out prices. I recommend understanding both and learning how to apply them together, which will amend Forex trading results.

Technical Analysis

Technical analysis uses past price action, chart blueprint formation, and mathematical indicators to determine future moves. It is ideal for brusque-term trading strategies but requires intensive research, trial-and-fault testing, and fine-tuning. Automated trading solutions are excellent to assistance traders with technical analysis ad form the basis of quantitative trading.

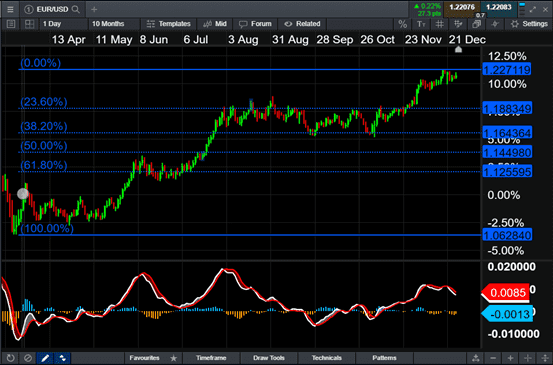

An instance of a technical analysis chart for the EUR/USD

Central Analysis

Primal analysis is best suited for long-term patterns and consists of economical reports, primal bank actions, and geopolitical events. All aspects remain unpredictable as analysts attempt to determine the intrinsic value and currency pairs with a disconnect to information. An economic calendar is one of the most-used tools during the process.

An case of an economic calendar

Final Thoughts

The Forex market is an excellent selection simply highly misunderstood among an ongoing wave of misleading marketing campaigns. The low upper-case letter requirements and high leverage brand information technology accessible to all, adding to its appeal. Forex trading is likewise platonic for automated trading solutions, which are plush but became a requirement for those who want to merchandise for a living. While everything remains in place for successful trading, Forex traders must approach information technology as a profession and not a hobby if they desire to succeed at it. Between 70% and 85% of retail Forex traders fail. The primary reason is that new traders replace the demand for education with unrealistic turn a profit expectations. Another significant error is trading with insufficient capital and using leverage without risk management. The Forex market presents traders with frequent trading opportunities, only dedication and a professional person mindset must prevail to capitalize on them.

FAQs

Can you become rich by trading Forex?

Yeah, merely information technology requires years or decades, depending on your upper-case letter, dedicated trading with a professional mindset.

How practise I first trading Forex?

I recommend learning every bit the start of Forex trading. It requires time, similar to becoming a pilot, an engineer, a doctor, a lawyer, etc.

Can I teach myself to merchandise Forex?

Almost successful Forex traders are self-taught, which is the best way to learn how to trade.

Can I trade Forex with $100?

It is possible to start, simply Forex trading requires significantly more uppercase than $100.

Source: https://www.dailyforex.com/forex-articles/2021/01/how-to-trade-forex/156817

Posted by: welschbutted.blogspot.com

0 Response to "Learn How To Trade Forex"

Post a Comment