Head And Shoulders Pattern Forex

The head and shoulders pattern is a technical formation that indicates a trend reversal is underway. For traders, information technology is an extremely useful pattern, whether they are tendency trading and want to be alerted of potential danger or they want to catch a trend reversal near the turning betoken.

In this article, we explore how head and shoulders patterns can be used to identify entry and get out points for a merchandise, as office of technical analysis. It is of import that traders learn how to spot and scan for this technical analysis pattern, and understand what it is telling you when it appears. We will as well wait at examples of head and shoulders trading in action during uptrends and downtrends, and how you tin incorporate technical assay into your trading strategy.

What is a head and shoulders pattern?

Head and shoulders patterns tin be used to highlight price activeness within a wide range of markets, including forex trading, indices and stocks. This makes information technology a particularly flexible and simple pattern for traders to spot on toll charts.

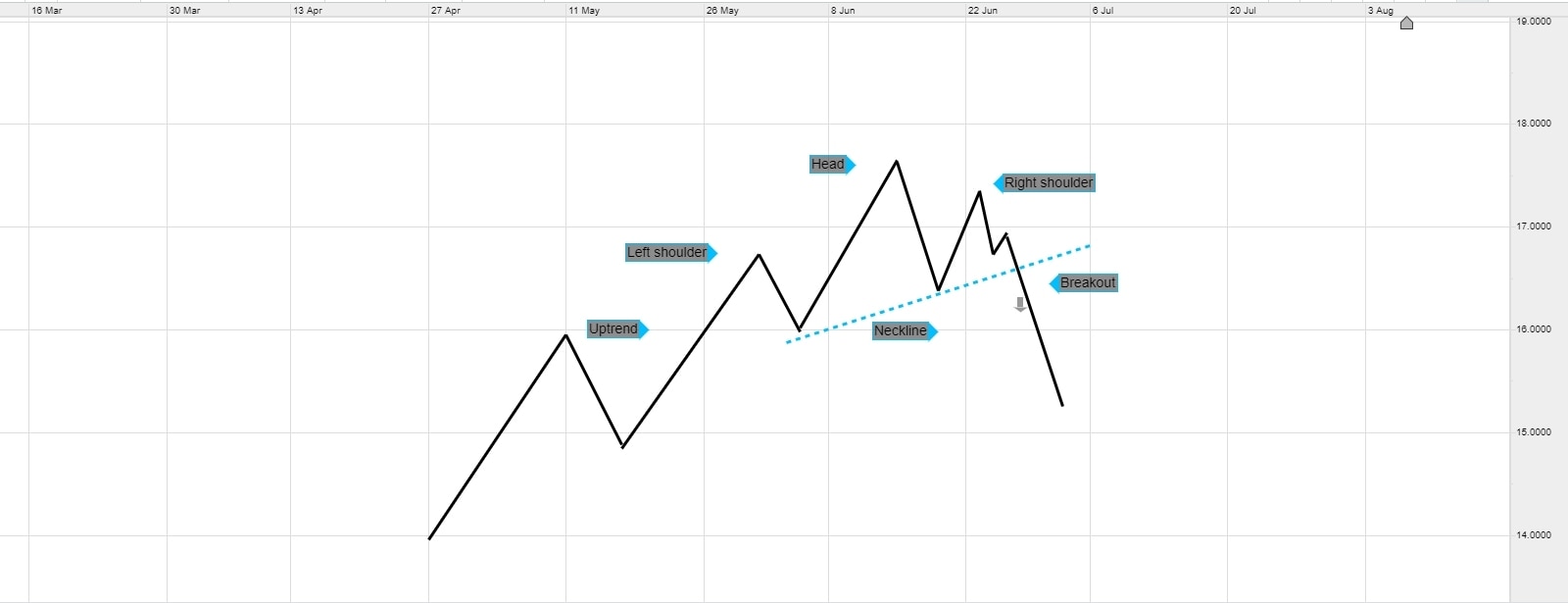

Head and shoulders formation

When the head and shoulders pattern occurs within an uptrend, the pattern starts with the toll rising and and so pulling back (lower), forming the left shoulder. The price rallies once more, creating a higher top, which is known as the peak of the head. The cost moves lower once again, and so rallies into a lower peak, forming the correct shoulder.

When the cost drops post-obit the left shoulder and the head, these are called swing lows. Connecting the swing lows with a trendline, extended off to the correct, forms a "neckline". When the price falls below the neckline, the pattern is considered consummate and the cost is probable to keep moving lower.

Example of a head and shoulders pattern

Below is an example of a head and shoulders blueprint that formed on a Bitcoin candlestick chart. After forming the left shoulder, head, and correct shoulder, the cryptocurrency dropped through the neckline, signaling that information technology would continue failing.

In this example, the correct shoulder is quite small-scale. The fact the price could not bounce significantly dorsum toward the head showed there was lots of selling pressure prior to the reject. This is what is called a head and shoulders top chart design.

Changed caput and shoulders pattern

An inverse caput and shoulders pattern occurs in a downtrend. The price is dropping and then has a temporary rally, forming the left shoulder. The price then drops to a new depression, before having another temporary rally. This forms the head. The price drops just is unable to make a new low before rallying once more. This forms the correct shoulder. The swing highs (rally highs) following the left shoulder and head are connected with a trendline to form the neckline. When the price breaks the neckline and moves to a higher place information technology, the price is likely to keep moving higher.

Here, we can encounter Macy'southward share cost declining until it forms an changed head and shoulders pattern. There is a tendency reversal to the upside when the price moves above the neckline. This is besides chosen a head and shoulders bottom pattern.

How to draw a head and shoulders design

Yous can identify head and shoulders patterns on trading charts, whether these be candlestick or Renko charts, using various cartoon tools to identify support and resistance levels and trendlines. Our online trading platform, Next Generation, has a wide range of cartoon tools, cost project tools and chart types to display your positions clearly. Follow the steps below to get started:

- Open a alive account to become started straight abroad, or practise first with virtual funds on our demo business relationship.

- Open a live chart by selecting an instrument from the Production Library. Nosotros offer over 330 forex pairs and 8500 shares on our platform, forth with other popular financial assets.

- Along the lesser of the chart, you volition run across several tools: Timeframe, Draw Tools, Technicals and Patterns. For head and shoulders patterns, select the Describe Tools tab.

- Y'all at present have some more than options. To draw lines over the cost activeness to better run into the caput and shoulder patterns, or to describe the neckline, select the Trend tool, and then click where yous want the line to first and finish. Click on it again to change its settings or to movement the line. This style, you lot can run across the caput and shoulder pattern more conspicuously.

- Also useful is the Note tool, which can also be constitute in the Draw Tools carte. Select information technology and click on the chart where you lot want to put a annotation, such every bit "left shoulder" or "pinnacle of head". This will assist you lot to remember the head and shoulders formation.

Cartoon a head and shoulders pattern with the help of our platform drawing tools helps traders to analyse the head and shoulders patterns that appear on like price charts.

Head and shoulders trading strategy: entry, cease loss and profit target

The entry opportunity on a head and shoulders blueprint occurs when the price breaks the neckline. When identifying points of entry and exit on a price chart, you should brand sure that you have a sufficient risk direction strategy in place. A end-loss society is typically placed above the right shoulder for a topping design and is placed below the right shoulder for a bottoming pattern.

For an estimated profit target or price target, you lot could measure the distance of the pattern from low to high and add it to the neckline breakout point for a bottoming blueprint (an inverse head and shoulders). And so, yous could subtract the elevation of the pattern from the neckline breakout point for a topping pattern.

The pinnacle, or distance, is measured from the height of the head to the everyman swing low within the topping pattern. If one of the swing lows was extreme (creating a very steeply angled neckline), yous can use the higher swing low to generate a smaller height and therefore a more bourgeois toll target. For a bottom pattern, the height is the lesser of the caput to the acme of the highest swing high within the pattern. If 1 of the swing highs was extreme, you lot can use the lower swing high that volition result in less height and, over again, a more conservative profit target.

Head and shoulders blueprint screener

Head and shoulders patterns are tradable, providing opportunities for entry, finish loss, and profit targets. To exercise this, pattern recognition software can exist useful for identifying caput and shoulders patterns on charts. Our award-winning Next Generation platform includes a chart pattern scanner, not just for head and shoulders, but many other patterns as well, such as cup and handle and double superlative/bottom patterns.

While the software is useful, it should non be relied on lone. Sometimes, the software may think it recognises a set of cost bars as a head and shoulders where it does not exist, or it may place ane that does non provide trading opportunities. For example, it may exist besides small or too big to trade, or the pattern may not be visible. Therefore, design recognition is a good starting signal for finding patterns, merely it is also a good idea to analyse the results manually to detect patterns that resemble the examples shown in this guide.

Head and shoulders patterns: are they bullish or bearish?

The appearance of a head and shoulders is not initially bullish or bearish until there is a breakout. An inverse bottoming pattern could course, simply until the price breaks above the neckline and keeps moving higher, the price could still be in a downtrend. If the price breaks below the pattern, that signals a continuation of the downtrend, not a reversal.

Similarly, when a topping pattern forms, this does not hateful that the cost will reverse. The toll has to break below the neckline and keep dropping in lodge to ostend the reversal. If a head and shoulders forms but the price rallies higher up the pattern instead of dropping below information technology, this signals a continuation to the upside, not a reversal to the downside. To confirm which management the toll is going in, in some cases, you could wait for the neckline pause.

Head and shoulders in forex

Head and shoulders patterns occur in all markets, including forex trading, and the pattern is traded in the same way. Below is an instance using the major currency pair GBP/USD, with entry, finish loss and profit target opportunities marked using our online trading software.

Stocks with a head and shoulders blueprint

With stocks, you lot can look for an uptrend where the price has formed three peaks, with the middle peak being the highest. Be sure to place a stop loss, and expect to sell or short stock until the price moves below the neckline. The default location for the stop loss is in a higher place the right shoulder, but to reduce the size of the possible loss, you lot could place it in a higher place any swing high that preceded the neckline breakout.

Calculate the height of the pattern, then subtract that amount from the breakout point to attain a profit target. Beneath is an example using the Apple stock nautical chart, with a blueprint height of 21.09. For a setup that provides a buy signal, traders should await for an inverse caput and shoulders pattern, as seen in the Macy's share instance that we mentioned earlier in this article. Acquire more than about stock nautical chart patterns.

How reliable is the head and shoulders pattern?

The head and shoulders pattern can marker the end of an uptrend or downtrend, just you lot should wait for the price to intermission through the neckline earlier acting, as this is the indicate where the price reversal is frequently confirmed. It is typical to measure the distance or height of the design for an estimated turn a profit target, employ the right shoulder for stop loss placement, and the neckline for an entry point (or peradventure an go out indicate).

As with all advanced technical assay patterns, there are both advantages and drawbacks when it comes to trading caput and shoulders chart patterns. The profit target is an estimate, meaning that not merely will the price not necessarily go that far, only it could also run much further.

Some traders volition opt to focus on patterns with certain characteristics. For example, a small right shoulder means a smaller stop loss, compared with a large right shoulder. This improves the risk-to-reward ratio of the trade, considering while the turn a profit approximate is based on the unabridged height of the pattern, the stop loss is merely based on the much smaller distance between the neckline and the right shoulder. Looking for like characteristics can motion the odds more in a trader's favour, over multiple trades. However, on a single trade, annihilation can happen.

Seamlessly open and shut trades, track your progress and prepare alerts

Source: https://www.cmcmarkets.com/en/trading-guides/head-and-shoulders-pattern

Posted by: welschbutted.blogspot.com

0 Response to "Head And Shoulders Pattern Forex"

Post a Comment